LM portfolio as at 19/01/2024:

| Code | Sector | Date Bought | Cost | Value | Gain/Loss |

|---|---|---|---|---|---|

| LM055 LM055-2 LM055-3 |

General Financial | 11/01/2023 02/05/2023 20/12/2023 |

£3850 | £4920 | 27.98% |

| LM057 LM057-2 LM057-3 |

Gas, Water & Multiutilities | 12/01/2023 30/05/2023 06/09/2023 |

£3810 | £4420 | 16.09% |

| LM058 LM058-2 |

Support Services | 17/01/2023 20/07/2023 |

£2540 | £2650 | 4.22% |

| LM061 LM061-2 |

Aerospace & Defense | 20/02/2023 13/10/2023 |

£2540 | £3000 | 17.86% |

| LM071 LM071-2 |

Construction & Materials | 24/07/2023 22/09/2023 |

£2550 | £3140 | 23.00% |

| LM074 | Industrial Transportation | 24/07/2023 | £1270 | £1840 | 45.20% |

| LM075 | Equity Investment Instruments | 02/01/2024 | £1270 | £1180 | (7.16%) |

| LM076 | No Specific Industry | 03/01/2024 | £1270 | £1240 | (2.03%) |

| LM077 | Electronic & Electrical Equipment | 03/01/2024 | £1270 | £1200 | (5.58%) |

| LM078 | Banks | 03/01/2024 | £1270 | £1120 | (11.70%) |

I'm going to add a couple of charts today to illustrate the difference between the two trading methods used in the LISAMillionaire portolio.

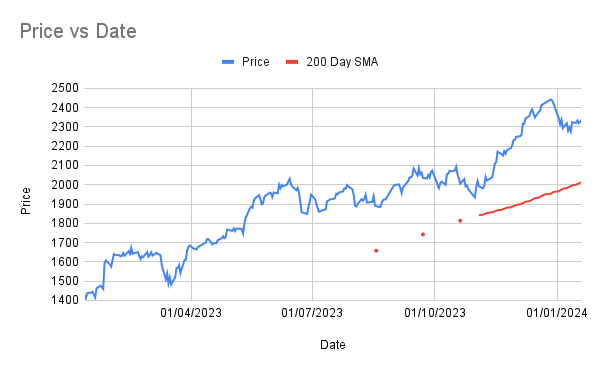

The first (Figure 1) shows the price action of LM055 over the last year or so:

This particular share was initially purchased because it had appeared in the "52 week high" list one weekend and when I checked its chart I was happy with what I saw.

As you can see, the price is shown in blue and I have added a 200 day SMA line in red.

The price has increased gradually and I have added two more units since the original purchase.

But... where will I sell?

On the up side, there's no limit. If this share continues to go up in price then I will let it sit in the portfolio and grow. I'm more than happy to do that.

On the down side, I imagine I would likely sell my entire holding if the price went below the 200 day SMA and stayed there for three days.

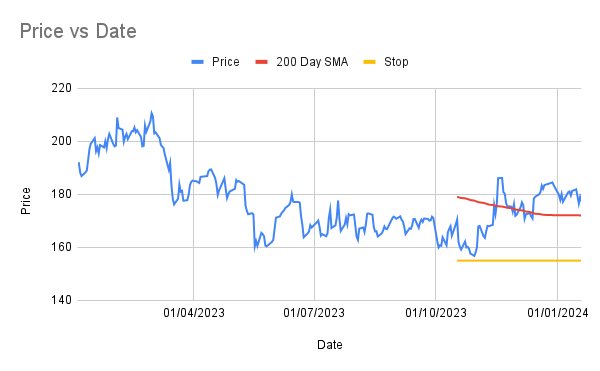

Figure 2 shows LM076 - a share I purchased using my "recovery" method. This is a new method and I am only testing it on a handful of shares.

On this particular chart I have added a third line in yellow which is the stop. If the price goes down to this line then I'll sell it because the so-called "recovery" I was hoping for hasn't happened.

I can't use the 200 day SMA as a stop here because the reason I bought the share was because it went over this line. It may spend a little time moving around this moving average before, hopefully, moving up.

My plan is to move the stop upwards as the share climbs in price, which is known as using a "trailing stop-loss". This is what Darvas did to make sure he didn't hold declining stocks - when they dropped too much they were automatically sold. Moving the stop up so it is just below the share price meant he was locking in profit and reducing his exposure to market falls. If the price falls and hits the stop-loss level, the share is sold and the profit banked.

Just something I thought might be interesting.

With any luck, LM076 will be a share that moves up in the same way as LM055 and in that case I will be able to come back to this in a few months and show an updated chart with a good example of a trailing stop-loss.

One thing to remember about trailing stop-losses is that they can only stay at the same level or be moved upwards. You don't move them down if it looks like they will be hit - that renders them useless.

It looked like the portfolio had hit a new high when I checked just before 5pm on the 12th January. LM057, in particular, had flown upwards and I quickly clicked into it to see what had happened. It was at that point that I saw what was wrong... the spreads on the share were all out-of-line as the market had just closed.

When I checked again the next day (Saturday) the portfolio value was back at realistic levels.

Everything is steady at present, although a couple of the positions which are in profit are flirting with levels that would see them being sold.

They are safe for now but further falls this week may see them banished by this point next Monday.