LM portfolio as at 24/12/2021:

| Code | Sector | Date Bought | Cost | Value | Gain/Loss |

|---|---|---|---|---|---|

| LM028 LM028-2 |

'No specific industry' | 16/11/2020 10/08/2021 |

£2280 | £3160 | 38.53% |

| LM037 LM037-2 |

Life Insurance | 03/03/2021 05/07/2021 |

£2290 | £2720 | 19.09% |

| LM038 | Banks | 10/03/2021 | £1020 | £1200 | 17.49% |

| LM039 | Pharmaceuticals & Biotechnology | 30/03/2021 | £1030 | £1150 | 11.77% |

| LM040 LM040-2 |

General Financial | 27/04/2021 22/11/2021 |

£2290 | £2830 | 23.17% |

| LM041 | Real Estate Investment Trusts | 27/07/2021 | £1270 | £1470 | 15.58% |

| LM042 | Construction & Materials | 27/07/2021 | £1270 | £1420 | 11.70% |

| LM045 | Gas, Water & Multiutilities | 06/12/2021 | £1280 | £1270 | (0.42%) |

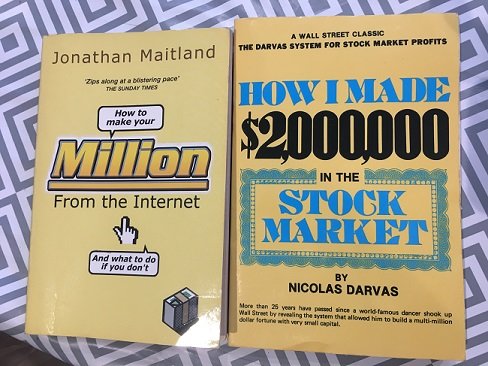

A few days prior to Christmas I took to eBay to order the two books pictured below:

Although I previously owned them I gave them away several months ago to a friend who had shown an interest in investing. I figured they are both good reads for anyone who is new to investing as they teach some excellent lessons.

The Jonathan Maitland book is in diary form so I was able to finish it in a couple of days, snatching a few pages here and there including a very lovely moment where I was also holding my sleeping 6 month old.

Though I have read it half a dozen times before, the descriptions of his spread betting exploits still make me wince. Were it not for his huge purchase of one particular share which did well - using 60% of his entire bank - it would've turned out much, much worse than it did.

Maitland did everything wrong; he overtraded, he sold winning shares and kept those which had dropped, he bought shares because they had dropped 50% from their highs, he took share tips from anyone and everyone.

Still, I'll always recommend this book as it's entertaining and serves to remind me what not to do.

The Darvas book is also short so that was also re-read swiftly. It's the concept of the "Box System" which sounds so appealing. Though I've never taken the time to try and distill it into a set of rules, I do think the way I choose trades is similar to what Darvas did.

For one, I buy new highs and then have a strict stop-loss in place. Secondly I like to "pyramid" trades when they are performing well.

Like Darvas, I never "top-slice" a position. This is where you sell some of your position to take some profits. I don't see the point... if you want to sell a share then sell the lot. Then maybe even go short. Why limit your profits by removing some stake from the table?

The one thing that Darvas does that I don't is use a trailing stop-loss. After reading this book again I feel this is a tool that could be well utilised in the LM fund.

So pick both up for pennies on eBay or Amazon, links in the reviews below:

How I Made $2 Million in the Stock Market by Nicolas Darvas

How to Make Your Million From the Internet (And What To Do If You Don't) by Jonathan Maitland

The LM Portfolio

No changes since the last update except the FTSE 250 rudely pinging straight back above the 200 day SMA for three days running.

Whilst that's a good thing because it means that as per my rules I can start purchasing new UK shares, it comes immediately after I closed a 3 unit position in the FTSE 250 because the rules told me to.

So that's a little annoying but not the end of the world. It only takes two minutes to re-open the same position should I decide to in the coming days.

Happy New Year! Next update will be summing up 2021's performance.