LM portfolio as at 25/09/2020:

| Code | Sector | Date Bought | Cost | Value | Gain/Loss |

|---|---|---|---|---|---|

| LM012 LM012-2 |

Real Estate Investment Trusts | 20/05/2019 28/11/2019 |

£2030 | £2320 | 14.11% |

| LM023 | ETF | 19/05/2020 | £1020 | £1000 | (1.91%) |

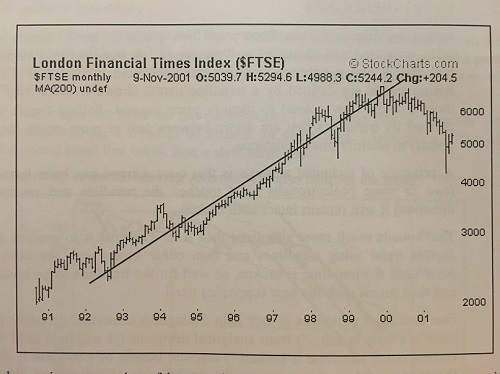

This week I was reading through an old trading course that was published in 2002 and was struck by this chart:

Over 18 years on and the FTSE 100 is still around the same level.

On Friday it closed at 5842 and from this chart you can see it was around that level in early to mid 2001 before it fell even further.

Obviously the big dip in September was from the 9/11 attacks but the market was already falling before it was affected by any terrorist acts.

And when you look back at the charts from 16-18 years ago, it is surprising to see that from the end of 1999 to March 2003 the market trended down. The high came on 31st December 1999 and then it fell and fell.

Down to 4500 with the September 11th attacks, then up to around 5500 for the first half of 2002 until it began to fall off again reaching 4000 again at the end of 2002.

Early 2003 saw further falls down to 3500 before the low of just under 3300 in March 2003.

From there the trend changed (moving above the 200 day SMA in May 2003) and the market rose steadily to reach almost 4500 at the end of 2003.

Think about that.

The market was falling, although not without some large up moves, for over 3 years.

We had the blip in March 2020 due to COVID. It recovered a little but the market remains below the 200 day simple moving average.

Yes, it could start rising on Monday and we may never see 5500 in the FTSE 100 again.

Conversely it could continue to fall, then rise, then fall further, then rise, then fall again, then range trend for a few months, then fall to sub 4000.

It's easy to forget how long it can take for trends to change and it certainly can't hurt to look back at what has happened previously.

Nothing's for certain in the markets and it's very easy to think we're over the worst after a few months.

Pictures like the above remind us that recovery can take years.

Hence why I continue to wait for solid signs that the market is moving upwards again.